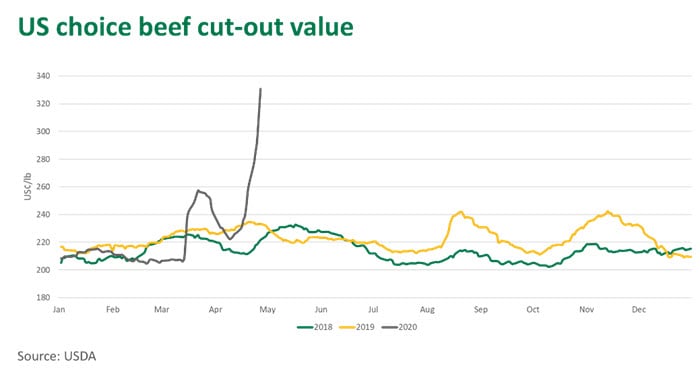

Just one month-ago, US markets witnessed the biggest rally in the beef cut-out value (a benchmark indicator of wholesale prices) in history, triggered by an unprecedented surge in retail meat demand as consumer panic buying set in. As discussed in this article two weeks ago, processors responded to price signals and supply ramped up to meet demand. Markets subsequently calmed.

However, now a new panic has set in, as COVID-19 has forced further processing plant closures. Early data suggests US weekly cattle slaughter last week was 29% below the peak five weeks ago and 27% below the same time last year, according to Steiner Consulting. The is a monumental turn around in supply. The supply shortage of product coming through the chain has sparked an even greater rally in the US cut-out value, increasing 46% over the fortnight to Tuesday and making the March rise look like a minor speed bump.

US beef processors are playing a delicate balancing act, trying to keep plants open to meet the obvious demand while taking sufficient measure to protect employee health and safety. The squeeze on processing capacity has simultaneously pressured cattle prices lower. As of Tuesday, the US choice fed steer (five market average) indicator was 16% below where it peaked a month earlier.

Feedlots have also reacted to the uncertainty, with facilities over 1,000 head capacity placing 22.7% fewer cattle on feed through March, despite lower feed costs. Reduced placements come on the back of an aggressive marketing month in March, when US feedlots pushed elevated numbers through to meet the surge in retail demand. Not only is COVID-19 triggering a short-term beef shortage, reduced feeder placements now will restrict the supply of fed cattle in coming quarters.

US imported beef prices are yet to register a similar magnitude rally as domestic wholesale values. The price rise in March translated into some gains for Australian beef exports but the trade is geared to the US quick service burger market, which has recorded mixed results compared to resurgent retail channels. Further gaps from processing disruption may appear in North Asia in coming weeks where Australia competes head to head with US beef.

However, the degree to any sustained market opportunity for Australian beef will hinge on how long the US processing capacity crunch lasts. With Trump issuing an executive order to keep meat processing plants open, such opportunities may not last long.

© Meat & Livestock Australia Limited, 2020