The impact of Covid-19 on each country’s red meat market will be shaped by many factors. This includes underlying ones, such as the degree of dependence on imports and the prominence of red meat in consumer diets, and more immediate ones, such as how virus-spread control measures are implemented and ability of the healthcare system to deal with serious cases.

Covid-19’s impact in China was compounded by the crisis coinciding with Lunar New Year, typically the peak season for red meat purchases and consumption and when many businesses shut down for 1-2 weeks holiday. Hence, labour shortages across the supply chain due to quarantining, illness and travel bans were compounded by the national holiday.

While the epicentre of Wuhan responded with the deepest and longest shutdown, our insights below refer mostly to the rest of the country, particularly coastal Tier 1 and 2 cities where the vast majority of Australian red meat arrives, is stored, distributed, further processed and consumed.

Despite its unique dimensions, China, as the first country to deal with Covid-19, can illustrate the impact on red meat through supply and logistics, sales channels and consumption habits. China offers insight into some likely impacts, challenges and opportunities as the virus spreads into other markets.

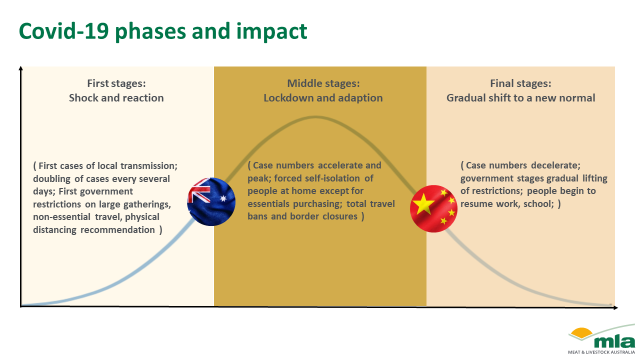

The evolution of Covid-19, and the impact on logistics and consumer markets, can be considered in three primary phases: shock and reaction, lockdown and adaption, and a gradual shift to a new normal. These stages are discussed below but, given China and the rest of the world remain in uncharted territory, it is unclear how the landscape may continue to evolve, with second-wave infection posing added risk.

First stages: Shock and reaction

Panic purchasing of all red meat segments (from hot loose, chilled & frozen packaged to canned and meat ready-meals) for stock-up, prioritising volume purchasing of familiar staple cuts for traditional day-to-day dishes, which in China tends to be more bone-in cuts for wet slow-cooking rather than steak cuts for pan frying. Sudden panic-buying disrupts meat retail inventories and supply. Many wet markets start to close with retailers focusing on boosting supply of staple cuts. Consumer purchasing focuses on availability with less price sensitivity. Consumers begin avoiding eating with large family and social groups and avoid eating out at restaurants, with some increase in take-away and delivery food services. Higher-end foodservice outlets mostly shut down, with some excess meat supply diverted to retail. Some mid- and lower-end outlets adjust operations to meet higher demand for drive-through, take-away and home delivery services.Middle stages: Lockdown and adaptation

Supply and logistics:

Air-freight drops with travel bans and reduced passenger flights, causing supply disruption into some channels. Port activity slows and refrigerated containers build up, hindering supply of imports and re-circulation of refrigerated containers back into the global market. Travel bans and labour shortages disrupt product delivery to retail and foodservice channels. Expansion of non-contact distribution services (online, home delivery, click-&-collect) by some grocery retailers and foodservice operators challenged by labour shortage and transport bans.Consumer changes:

Consumers shift to mostly scratch-cooking of familiar dishes at home with fresh produce and meat, interspersed with occasional prepared foods, meal delivery and home-cooking experimentation for variety and enjoyment. Cooking and eating become a particularly important element of lock-down home life and spending on fresh grocery increases. Higher priority placed on hygiene and dietary nutrition for health and immunity and, hence, greater consumption of red meat for its perceived high nutritional value. Stronger demand for safe, high quality meat, benefiting premium suppliers like Australia. Greater use of contactless service offerings for fresh grocery delivery. Shift from purchasing hot, loose meat to chilled, packaged meat, particularly from local modern smaller-format grocery stores.Retail and foodservice:

Shift in offline grocery retail traffic as hours are amended, with some growth in local smaller-format grocery retail and most wet markets close. Greater emphasis on hygiene and packaging of popular staple cuts. Operational adjustments made to meet higher demand for hygienic front-gate delivery of packaged fresh produce and meat. As eating-out shuts down, consumers explore other options for variety and home-cooking relief, turning to ‘contactless’ online meal services for front door delivery, drive-through and take-away. Hotel food services mostly closed, with room service only where open.Final Stages: Gradual return to a new normal (At this stage these are potential forecasts for the future)

Supply and logistics:

Lack of travel and tourism still limiting air freight. Port back-logs begin to clear and lifting of domestic travel and work bans facilitate resumption of meat processing and distribution to retail and foodservice. Businesses review their strategies for supply chain digitisation, diversification and inventory management with greater focus on risk management.Consumer changes:

Consumer demand begins to return to normal and discretionary spending increases, as interest in novelty and variety re-emerges. Sustained prioritisation of safety, hygiene, trust and transparency, with higher demand for chilled, packaged meat products from modern retail stores. Resumption of some occasional eating out to satisfy pent-up demand.Retail and foodservice:

Restaurants begin to open, mid- and lower-end more quickly than higher-end, with hotel foodservice slower to resume as people continue to avoid unnecessary travel. Retailers begin to provide a wider range of chilled packaged meat product assortment to meet higher consumer need for trust and higher quality semi-prepared product, as consumers maintain a higher commitment to home cooking and eating. Sustained expansion of contactless delivery services and further development of omni-channel merging of retail and foodservice offers initially driven by consumer demand during lockdown.It is clear now that even though China appears to be emerging from Covid-19 shutdown, the crisis is escalating in the rest of the world and will continue to disrupt consumption of Australian red meat domestically and around the globe.

What’s Next?

In the coming weeks, MLA will present further insights into Covid-19 implications for Australia’s red meat industry including potential changes in consumer behaviour and shifts in post-crisis retail and foodservice offerings.

Read here for more insights on Covid-19 impact on Australian red meat air freight.

© Meat & Livestock Australia Limited, 2020